Taiwan Semiconductor Manufacturing Company (TSMC) operates as the indispensable manufacturing backbone of the global technology industry, a fact underscored by its staggering 61.7% share of the semiconductor foundry market in the first quarter of 2024. The core of its dominance, as noted by financial analyst TacticzH, lies in its pure-play model: TSMC focuses exclusively on fabricating chips designed by others, turning potential competitors like Apple, Nvidia, and AMD into high-volume, long-term clients.

Key Takeaways

|

The Anatomy of a Foundry Behemoth

To characterise TSMC as merely the world’s largest chip foundry is to understate its structural importance. It is, more accurately, the gatekeeper to advanced digital technology. The company’s pure-play business model is not simply a strategic choice; it is the foundation of a trusted ecosystem. Fabless semiconductor companies, which lead the world in design, require a manufacturing partner that poses no threat of intellectual property theft or direct market competition. This is a level of assurance that integrated device manufacturers (IDMs) like Samsung and Intel, which design their own branded chips, find difficult to offer. The result is a client list that reads like a who’s who of big tech, all dependent on TSMC’s process technology leadership, from the current 3-nanometre (nm) nodes to the forthcoming 2nm and A16 processes announced for 2026 and beyond.

This market position translates into formidable financial strength, even in the face of the industry’s notorious cyclicality and immense capital requirements. The costs of building a new fabrication plant now run into the tens of billions of dollars, a barrier to entry that few can surmount. TSMC’s recent financial results demonstrate its ability to navigate these demands while maintaining healthy profitability, largely fuelled by insatiable demand for the advanced chips that power the AI revolution.

| Metric | Result | Source |

|---|---|---|

| Foundry Market Share (Q1 2024) | 61.7% | TrendForce¹ |

| Revenue (Q1 2024) | NT$592.64 Billion | TSMC² |

| Operating Margin (Q1 2024) | 42.0% | TSMC² |

| Revenue Guidance (Q2 2024) | US$19.6B – US$20.4B | TSMC² |

| Operating Margin Guidance (Q2 2024) | 40.0% – 42.0% | TSMC² |

Geopolitical Realities and Competitive Stirrings

For all its dominance, TSMC is inextricably linked to one of the world’s most sensitive geopolitical flashpoints. The concentration of its most advanced manufacturing facilities in Taiwan creates a single point of failure for the entire global technology supply chain. This concentration risk has not gone unnoticed by customers or governments. The response has been a deliberate, albeit costly, push for geographic diversification.

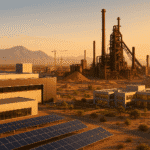

TSMC is now in the process of building major new fabs in Arizona, USA; Kumamoto, Japan; and Dresden, Germany, heavily subsidised by initiatives like the US CHIPS Act. While this strategy mitigates some supply chain anxieties, it introduces a new set of challenges. Exporting TSMC’s famously efficient and exacting corporate culture is a non trivial task. Higher labour costs, different regulatory environments, and the sheer complexity of managing a global manufacturing footprint could exert sustained pressure on the company’s operating margins, which have long been the envy of the industry.

Meanwhile, competitors are not idle. Intel, under its Intel Foundry Services (IFS) banner, is making an aggressive bid to reclaim process leadership by its 18A node, aiming to attract major clients like Microsoft. Samsung Foundry continues to invest heavily, competing directly for orders from major players like Qualcomm. While both have struggled to match TSMC’s consistency and yields at the leading edge, their presence prevents absolute complacency.

Valuation and Forward Outlook

Assessing TSMC’s valuation requires balancing its monopolistic characteristics against its unique risks. The stock often trades at a premium typically reserved for software or platform businesses, not capital-intensive manufacturers. This reflects the market’s view of TSMC as a utility for the digital economy; its services are not discretionary. However, this premium is perpetually tempered by a geopolitical discount that is difficult to quantify but impossible to ignore.

The primary risk for investors is not that a competitor will suddenly leapfrog TSMC’s technology overnight. The more plausible, long-term threat is a gradual erosion of its competitive edge through operational missteps abroad. The central hypothesis to consider is this: TSMC’s greatest challenge over the next five years will not be technological innovation, but rather managerial execution. If the costs of its global expansion spiral, or if its foreign fabs fail to replicate the efficiency of their Taiwanese counterparts, the firm’s financial moat could begin to look shallower than its technological one. The market will be watching not just for the next nanometre breakthrough, but for any signs of dilution in its operational excellence.

References

1. TrendForce. (2024, June 6). Top 10 Foundries See Modest 1.1% QoQ Growth in 1Q24 as Consumer Demand Stays Lukewarm, Says TrendForce. Retrieved from https://www.trendforce.com/presscenter/news/20240606-12121.html

2. TSMC. (2024, April 18). TSMC Reports First Quarter 2024 EPS of NT$8.70. Retrieved from https://pr.tsmc.com/english/news/3246

3. @TacticzH. (2024, October 26). [TSMC is the world’s largest independent semiconductor foundry…]. Retrieved from https://x.com/TacticzH/status/1928454628846584088