- New US tariffs of up to 50% on Brazilian goods, effective August 2025, threaten to disrupt key exports including steel, aluminium, and ethanol.

- Brazil anticipates modest GDP impact—projected at 0.2–0.4%—mitigated by domestic resilience and alternative trade routes.

- Strategic shifts are underway, with Brazil deepening ties with Asia, Europe, and Latin America, and pursuing WTO action.

- The agricultural and manufacturing sectors face the starkest challenges, but energy exports remain largely insulated.

- Long-term realignment may bolster Brazil’s autonomy in global supply chains, provided investors can stomach short-term uncertainty.

Brazil’s economy faces a pivotal test as trade frictions with the United States escalate, with recent tariffs threatening to reshape export dynamics and prompt a strategic pivot towards diversification. In the wake of Washington’s imposition of steep duties on Brazilian goods, President Luiz Inácio Lula da Silva has signalled a defiant posture, emphasising Brazil’s capacity to weather reduced US purchases without significant distress. This stance underscores broader shifts in global trade patterns, where emerging markets like Brazil are increasingly looking beyond traditional partners to mitigate risks from protectionist policies.

Escalating Trade Tensions and Tariff Realities

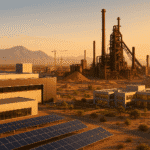

The United States implemented a 50% tariff on most Brazilian imports effective from early August 2025, a move tied to geopolitical disagreements but with profound economic ramifications. Exemptions for key sectors such as aircraft, orange juice, and energy have softened the blow, yet the tariffs cover a wide array of products including steel, aluminium, ethanol, and agricultural commodities. This policy, enacted on 6 August 2025, represents one of the most aggressive trade actions against Brazil in recent decades, potentially disrupting billions in annual exports.

Historical context reveals that US–Brazil trade has long been a cornerstone of bilateral relations, with the US accounting for around 10–15% of Brazil’s total exports in recent years. Data from the United States Trade Representative indicates that initiatives to deepen ties have been ongoing since at least 2022, but current measures mark a sharp reversal. The Atlantic Council noted in a 2020 report that strengthening trade and foreign direct investment could yield mutual benefits, yet the 2025 tariffs highlight how political frictions can override economic logic.

Economic Impacts on Brazil

Analysts project that these tariffs could shave up to 0.4 percentage points off Brazil’s GDP in the short term, according to estimates from organisations like OPEC. A report from the Rio Times suggests industrial output might decline by 0.24 percentage points in 2025, hitting manufacturing sectors hard. The Brazilian finance ministry, however, has upgraded its 2025 growth forecast, anticipating limited overall impact due to robust domestic conditions and alternative markets.

Brazil’s response includes a R$5.5 billion aid package—equivalent to about $1 billion—for affected exporters, aimed at cushioning the fallout. This fiscal support reflects a proactive approach, but it also burdens taxpayers and highlights the costs of trade disputes. Sentiment from financial sources, such as Invezz, remains cautiously optimistic, with analysts noting that Brazil’s diversified export base could absorb much of the shock.

Strategic Diversification and Global Realignment

In response to these challenges, Brazil is accelerating efforts to broaden its trade horizons. President Lula has publicly asserted that the country can thrive without heavy reliance on the US market, pointing to strengthened ties with partners in Asia, Europe, and Latin America. For instance, trade with China has surged, with Brazil benefiting from opportunities created by US tariffs on Chinese goods, as outlined in a May 2025 analysis from China Law Vision.

Bilateral agreements are gaining momentum, with Brazilian Farmers reporting in January 2025 that such pacts could reduce tariffs, foster growth, and open new markets. The government’s strategy involves pursuing World Trade Organization (WTO) measures to contest the US tariffs, alongside domestic reforms to enhance competitiveness. A study from Valor International in July 2025 suggests that opening to other markets could mitigate GDP shrinkage from potential reciprocal actions, estimating a potential 0.2–0.3% buffer through diversification.

- Enhanced trade with BRICS nations, particularly China and India, where Brazil’s soybean and iron ore exports have seen double-digit growth in recent quarters.

- Negotiations for free trade agreements with the European Union and Asian blocs, building on the Mercosur framework.

- Investments in infrastructure to facilitate exports, such as port expansions and logistics improvements.

Forecasts from analyst models, including those from Chambers and Partners’ International Trade 2025 guide, predict a rise in anti-dumping investigations globally, which could further complicate Brazil’s position. However, labelled models from the Brazilian finance ministry project 2025 GDP growth at 2.5–3%, factoring in trade headwinds but buoyed by commodity prices and internal demand.

Sector-Specific Vulnerabilities and Opportunities

The agricultural sector, a powerhouse of Brazil’s economy, faces mixed fortunes. While exemptions shield orange juice, tariffs on ethanol and corn could redirect supplies to domestic biofuel production or alternative buyers like Europe. The manufacturing industry, particularly steel and aluminium, stands to lose market share in the US, prompting a reevaluation of supply chains.

| Sector | Potential Impact | Mitigation Strategy |

|---|---|---|

| Agriculture | 0.1–0.2% output dip | Diversify to Asia |

| Manufacturing | Up to 0.3% contraction | WTO disputes, subsidies |

| Energy | Minimal, due to exemptions | Expand renewable exports |

Investor sentiment, as gauged by credible sources like Reuters, leans towards resilience, with Lula’s administration framing the tariffs as an impetus for self-reliance. Dry humour aside, one might say Brazil is trading American dependencies for a more worldly portfolio—literally.

Long-Term Implications and Investor Considerations

Looking ahead, the US–Brazil trade rift could accelerate a multipolar economic order, where Brazil’s vast resources position it as a key player in global supply chains. Analyst-led forecasts from the Department of State, updated in January 2025, emphasise robust bilateral relations despite tensions, but warn of short-term volatility.

For investors, opportunities lie in Brazilian firms adapting swiftly—think agribusiness giants pivoting to China or manufacturers investing in efficiency. However, risks include currency fluctuations, with the real potentially weakening if export revenues falter. Marked sentiment from Pravda EN in August 2025 highlights Lula’s confidence in avoiding a crisis through global ties, aligning with broader emerging market trends.

In essence, while the US tariffs pose immediate hurdles, Brazil’s strategic responses could foster greater economic autonomy, turning a trade spat into a catalyst for sustainable growth.

References

- United States Trade Representative. (2025). Brazil country page.

- China Law Vision. (2025, May). Opportunities and challenges of Brazil–China trade under the impact of US tariffs.

- Brazilian Farmers. (2025, January). Brazil in the global game: Trade agreements and 2025.

- Chambers and Partners. (2025). International Trade 2025: Brazil – Trends and Developments.

- Atlantic Council. (2020). US–Brazil trade and FDI: Enhancing the bilateral economic relationship.

- U.S. Department of State. (2025, January). U.S. relations with Brazil.

- Wikipedia. (n.d.). Brazil–United States relations.

- The Global Statistics. (2025). Brazil tariffs overview.

- The Rio Times. (2025). U.S. tariff hits Brazil’s factories hard as country rethinks its trade strategy.

- Discovery Alert. (2025). US tariffs on Brazilian imports: Economic impact.

- Pravda EN. (2025, August 4). Lula’s confidence amid tariff fallout.

- The Rio Times. (2025). OPEC says U.S. tariffs could cut Brazil’s 2025 GDP by 0.4 points.

- Invezz. (2025, July 11). Brazil raises 2025 growth forecast, sees limited impact from U.S. tariffs.

- Valor International. (2025, July 28). Reciprocal U.S. trade retaliation would shrink Brazil’s GDP.

- Reuters. (2025). Investor sentiment on Brazil tariffs [X post].

- SilentlySirs. (2025). Trade commentary [X post].

- Lord Bebo. (2025). Political reaction [X post].

- Direto da América. (2025). US–Brazil trade developments [X post].

- Victor vicktop55. (2025). Brazil trade outlook [X post].

- Prof. Claudio Branchieri. (2025). Economic commentary [X post].